what to do if tax return is rejected

A tax return rejected code R0000-902-01 means your Social Security Number has been used in that current year to e-file a tax return. If you filed with Credit Karma Tax last year and youve already started.

What Happens If Your Bank Rejected Tax Refund Mybanktracker

Select Fix it now and follow the instructions to update the info causing the reject.

. The code is in the email you received and in TurboTax after selecting Fix. Select Fix my return to see your rejection code and explanation. Prepare e-File and print your tax return right away.

If your return is rejected you must correct any errors and resubmit your return as. Rather when you first submit your return a computer will verify if all of your basic identifying information such as your Social Security number is correct. Tax returns are rejected because a name or number in the tax return does not match the information contained in the.

The IRS will reject your return if the AGI you entered doesnt match the number in the IRS e-file database. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number. If not it wont be.

Misspell your name hey it can happen to the best of us The IRS will also generally reject a tax return if it. If you owe tax due then file and pay the amount due as shown on the Form 1040 but expect a bill later from the IRS for the penalty and interest you will owe. The IRS generally corrects mathematical errors without denying a return.

Misspell your name hey it can happen to the best of us The IRS. Enter the wrong Social Security number. July 10 2020.

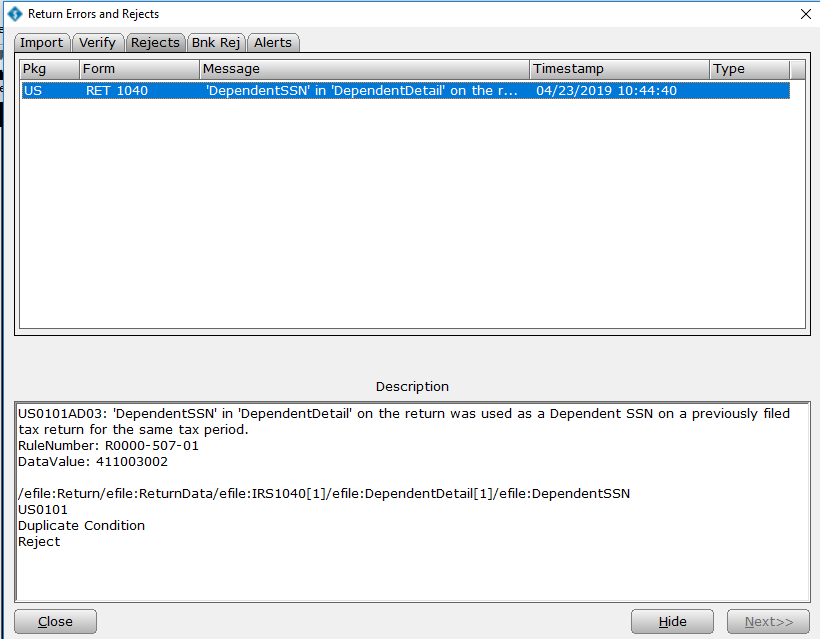

The rejection code IND-510 means your Tax. For example if your return is rejected because someone else uses your SSN your spouses SSN or your dependents SSN without authorization you may need to print your return. What happens if tax return is rejected.

You havent filed if the IRS rejects your return. Starting with tax year 2021 electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit APTC on Form 8962. This spring millions of taxpayers registered to get a stimulus payment through the IRS non-filer tool or by filing a 1 stimulus return through a tax.

Enter the wrong Social Security number. To fix your rejected return first find your rejection codeit indicates the reason your return was rejected. Sign in to TurboTax.

Enter the wrong date of birth. You may end up having your tax return rejected if you. Enter the wrong date of birth.

When youre unsuccessful at e-filing a return the system is set up to generate a reject code so that you know exactly what information is missing or. Open your original e-filed return in the HR Block Tax Software you cant check the status from a duplicate file. Only the IRS will.

Using all 3 will keep your identity and data safer. This video address some of the commo. Click the Check Status link next to the return file in the Continue with a Saved.

For example if your return is rejected because someone else uses your SSN your spouses SSN or your dependents SSN without authorization you may need to print your return.

Turbotax Tax E File Federal And State Return Rejected After Correcting Agi Adjusted Gross Income Fix Youtube

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name Don T Mess With Taxes

Resubmitting E Files And Extensions

Why Is My Tax Return Getting Rejected 5 Top Reasons Why An E File Fails Youtube

How To Fix Your Rejected 990 Pf Irs Error Code F990pf 902 01

Fraudulent Tax Return And Identity Theft Prevention Steps

10 Steps To Take If Your Tax Return Is Rejected Gobankingrates

Tax Return Rejection Codes By Irs And State Instructions

Irs Assessment Period For Rejected E File Valid Tax Return

The Most Common Causes Of E Filing Problems

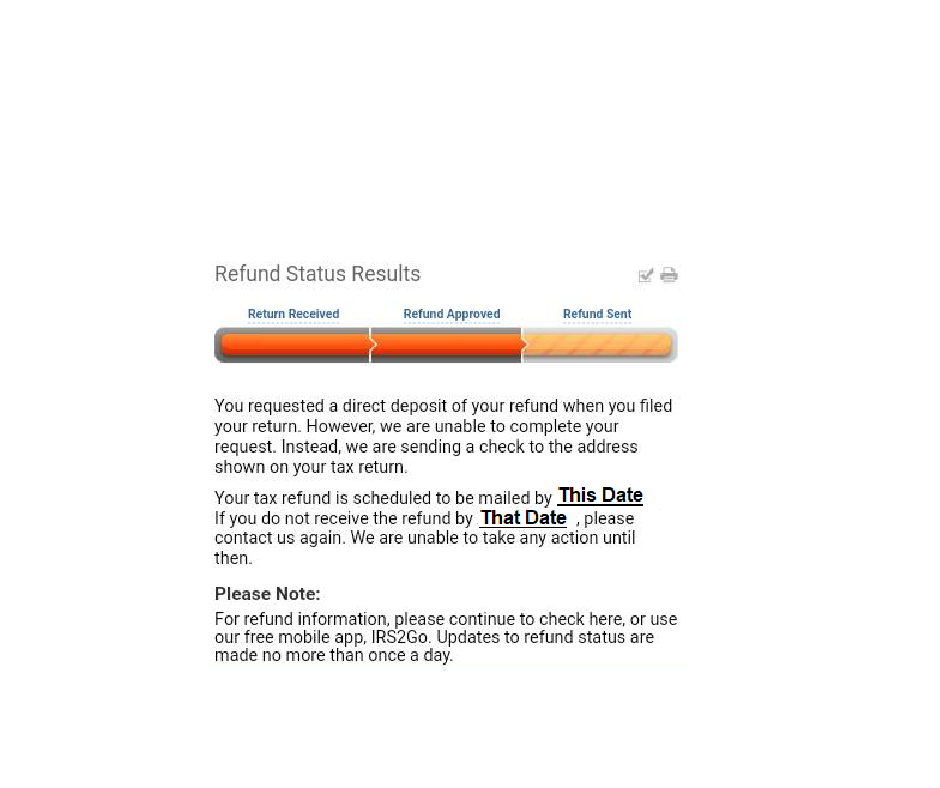

My Simple Tax Return Was Rejected I Filled Out The Form And Entered My Direct Deposit Info To Get My Stimulus Check Will I Still Get A Check Or No

Irs Issues Statement On Health Care Reporting Requirement Michael Holden Pllc

Rejected Tax Return Help 1040 Com Youtube

Rejected Tax Deposit Where S My Refund Tax News Information

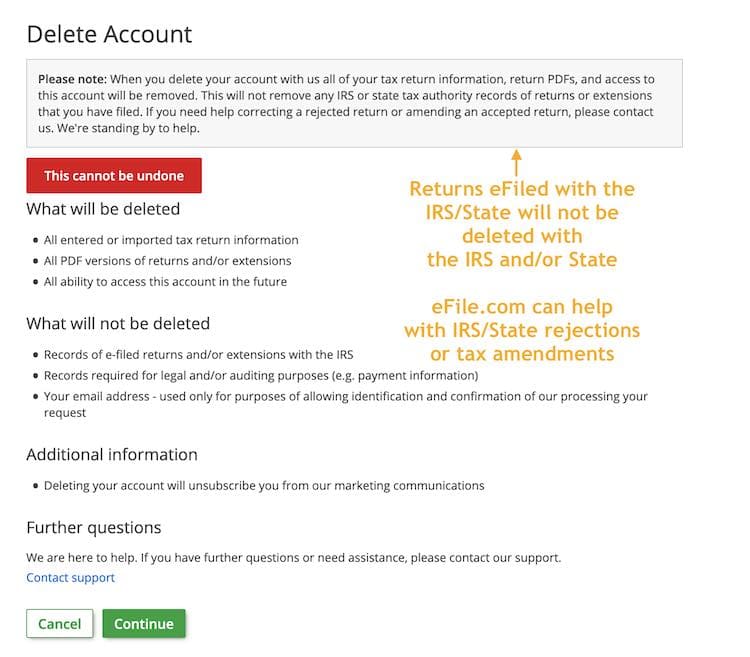

After You Have Deleted Your Efile Com Account

What Do Know If My Installment Agreement Was Rejected Irs Just Sent Me Letter 2272c Legacy Tax Resolution Services

How To Find The Reason That The Irs Or State Rejected A Tax Return Simpletax Support

4 Common Fixes For A Nanny S Rejected E Filed Federal Tax Return

How Do I Fix My Rejected Irs Tax Return 2022 What To Do If Irs Rejects Tax Return Irs News 2022 Youtube